- Investor Briefcase

- Posts

- The investor that stole $65 billion

The investor that stole $65 billion

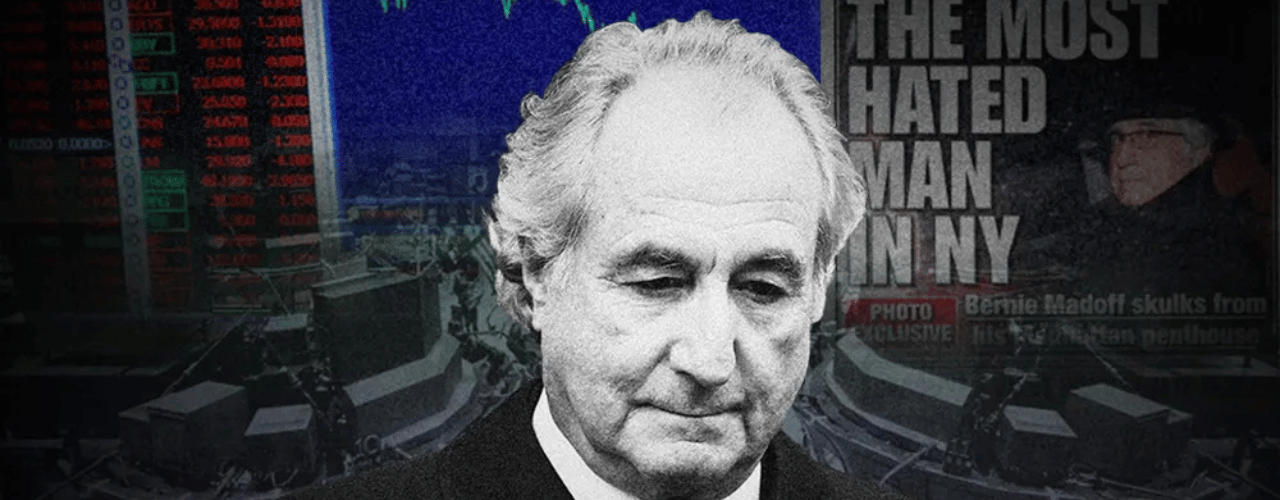

What happened to Bernie Madoff and the billions he stole?

Bernie Madoff was once the most successful hedge fund manager on Wall Street to never have bought a stock. With a house of lies, he convinced investors to give him over $65 billion until it eventually all collapsed.

His clients only ever recovered $14 billion of their original investment back. How did investors fall for Madoff's scam, and where did all the billions go?

Wall Street's Greatest Illusion

Bernie Madoff wasn’t just a Wall Street icon—he was the mastermind behind the largest financial fraud in history. For decades, he convinced some of the world’s wealthiest individuals to entrust him with billions of dollars, promising steady, above-market returns.

Madoff never bought a single stock. Instead, he ran a massive Ponzi scheme, paying off earlier investors with money from new ones. When his house of cards collapsed in 2008, it left thousands devastated and billions of dollars missing.

The Making of Madoff

Madoff’s career began in 1960 with a small trading firm when he started Bernard L. Madoff Investments using $5,000 he saved from his summer job as a lifeguard. At first, his firm focused on trading penny stocks. As Madoff’s influence grew, he capitalized on Wall Street’s technological evolution and became a pioneer of computerized trading.

Madoff climbed the ladder to become a respected figure, even helping launch NASDAQ and serving as its chairman for three terms. His gold-plated reputation was the perfect cover for what would become the largest financial deception in history.

In the 1990s, Madoff created his exclusive hedge fund that promised astronomical returns. He attracted deep-pocketed clients— including celebrities like Steven Spielberg, members of the European royalty, and global banks such as HSBC.

However, the issue was that Madoff’s hedge fund wasn’t making actual trades—it didn’t need to. He would instead funnel money from new investors to pay earlier ones while fabricating account statements that showed impressive profits. His image as a Wall Street titan lulled them into a dangerous sense of security and in total, the Madoff hedge fund managed over $65 billion before its collapse in 2018.

The Downfall and Life Behind Bars

In December 2008, Madoff confessed the fraud to his sons following intense investigations by the SEC, leading them to report their own father to authorities. His arrest shocked the financial world. In 2009, at 71 years old, Madoff pled guilty to 11 federal charges and was sentenced to 150 years in prison— having gotten away with it for decades.

His victims, from individuals to charities, were devastated, with many losing their life savings while recovery efforts returned only a fraction of the stolen funds. By the time anyone realized it was all smoke and mirrors, it was too late. Madoff had built his empire of lies by exploiting trust, reputation, and greed, all without ever making a single legitimate trade.

Madoff died in 2021 and his passing has caused speculation around the billions of dollars still missing. A majority is thought to have been lost in keeping up the Ponzi scheme, making a handful of investors extremely wealthy, while the remaining was spent on private jets, homes in the Hamptons, and billions supposedly hidden in offshore accounts.

More Stories

Infamous Ponzi Schemes

> From the man himself: Charles Ponzi made an estimated $15 million in eight months by convincing lenders to invest in international postal reply coupons.

> The man behind NSYNC: Lou Pearlman, the man behind NSYNC and the Backstreet Boys swindled investors and banks out of more than $300 million.

> The Texas tycoon: R. Allen Stanford masterminded a 20-year scheme via his offshore bank in Antigua, cheating almost 30,000 investors of nearly $7 billion.

> Earthlink founder: Reed Slatkin, founder of the internet service provider of the 90s, defrauded his investors of more than $500 million across 15 years.

> Stealing from pastors: Businessman Tom Petters was accused of stealing $3.7 billion from hedge funds, missionaries and pastors alike.

Each week we profile the most notorious investment stories.

Got an idea for a story? Email us at [email protected]