- Investor Briefcase

- Posts

- The first investor in Google

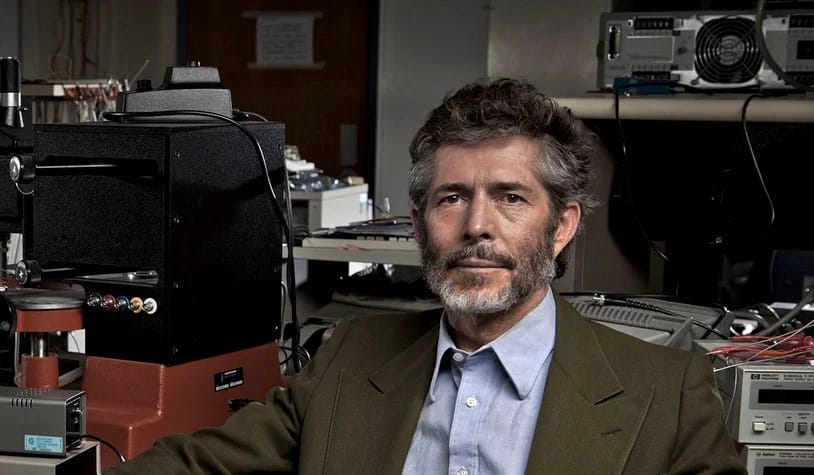

The first investor in Google

The professor who wrote Google's first check

David Cheriton is the Silicon Valley billionaire you’ve probably never heard of. He’s not a household name, avoids the spotlight, and still drives an old Honda. But this Stanford professor became one of Google’s first investors. A $100,000 check he wrote in 1998 turned into a fortune worth over $15 billion today.

This week, we dive into how David Cheriton became one of Google’s first investors, and why he remains one of tech’s most understated icons.

💸 Becoming The First Investor in Google

📊 From Professor to Billionaire

🧠 The Decision-Making of a Professor

— Investor Briefcase Team

Cheriton became a professor at Stanford University in 1981, and would eventually cross-paths with Larry Page and Sergey Brin which had enrolled into his Ph.D program in 1998. The two students were working on a search engine that ranked web pages based on their relevance.

One afternoon they approached Cheriton, asking for advice on their idea, an idea which would later become Google. Inviting them to pitch their idea at his home, the duo pitched their project—then called “BackRub”—to Cheriton and Andy Bechtolsheim. Andy had been a past student of Cheriton and the founder of Sun Microsystems which would later sell for $7.4 billion.

“It wasn’t just the idea—they had technical depth with the ability to execute on it. I could tell they were building something that would matter”

After a brief demo of their work, both Cheriton and Bechtolsheim decided to write a $100,000 check each to "Google Inc."—a company that didn’t even officially exist yet. The two had just become the first investors in an idea that would later become a trillion dollar conglomerate while turning their original investment into several billions.

David Cheriton’s decision to invest in Google wasn’t a shot in the dark. Before writing that check, he had already cemented himself as both a leading computer scientist and a sharp entrepreneur.

In the mid-1990s, he co-founded Granite Systems, a company focused on gigabit Ethernet technology. Cisco acquired Granite in 1996 for $220 million, giving Cheriton the capital and confidence to pursue new ventures.

His entrepreneurial instincts continued to deliver success after success. In 2004, he co-founded Arista Networks, which specializes in data center networking. Arista’s innovative approach to cloud-based systems propelled it to an IPO in 2014, and today the company has a market valuation of over $50 billion. Cheriton also co-founded Kealia, a company acquired by Sun Microsystems in 2004, and Apstra, which Juniper Networks bought in 2021.

"I invest in people who understand the problems they’re solving. Sometimes that just happens to be me as well.”

With his knack for picking winners, Cheriton’s decisions are never driven by hype. He has a laser focus on companies solving tangible problems with solid engineering, favoring depth and execution over flashy pitches.

His background as a professor of computer science gave him a unique edge in finding opportunities early-on as the internet was exploding in popularity. When Larry Page and Sergey Brin presented their project, Cheriton didn’t just see a bold idea—he saw the technical ability of the founders’ to bring it to life.

“Good ideas are common, but finding the right people to execute them is rare”

This approach to decision-making has extended to all of his investments. Cheriton has avoided trends and hype, which are frequent in tech, focusing on the ideas solving technical problems with sound engineering. His successful ventures like Granite Systems, Arista Networks, and Apstra reflect his decision to invest and build on ideas that he has a deep technical understand of.

Another hallmark of his philosophy is restraint. His selective, almost surgical approach to investing ensured that when he did make a move, it was with conviction.

“Success isn’t about how much money you make; it’s about the value you create and the problems you solve.”

David Cheriton’s legacy is defined not by his wealth, but by the thoughtful and deliberate way he created it. Even after becoming a billionaire, he has continued teaching at Stanford, mentoring the next generation of computer scientists. Keeping to a philosophy that true success comes from understanding the fundamentals better than anyone else.

Sponsored by RYSE

This Smart Home Company Hit $10 Million in Revenue—and It’s Just the Beginning

No, it’s not Ring or Nest—it’s RYSE, the company redefining smart home innovation, and you can invest for just $1.75 per share.

RYSE’s patented SmartShades are transforming how people control their window shades—offering seamless automation without costly replacements. With 10 fully granted patents and a pivotal Amazon court judgment safeguarding their technology, RYSE has established itself as a market leader in an industry projected to grow 23% annually.

This year, RYSE surpassed $10 million in total revenue, expanded to 127 Best Buy locations, and experienced explosive 200% month-over-month growth. With partnerships in progress with major retailers like Lowe’s and Home Depot, they’re set for even bigger milestones, including international expansion and new product launches.

This is your last chance to invest at the current share price before their next stage of growth drives even greater demand.

More Stories

Others early investors

> Masayoshi Son in Alibaba: Son, the founder of SoftBank, invested $20 million in Alibaba in 2000, turning out to be one of the most successful in tech history.

> Ron Conway in Airbnb: Conway, a well-known angel investor, was one of the first investors in Airbnb. His early investment helped the company scale to what it is today.

> Jeff Bezos in Google: Bezos, the founder of Amazon, was one of the early investors in Google, investing $250,000 in 1998

> Mike Markkula in Apple: Mike Markkula was one of the first investors in Apple, providing crucial funding and business expertise in the company’s early days.

Each week we profile the most notorious investment stories.

Got an idea for a story? Email us at [email protected]